Thank you!

TRS Independent Consultants have helped thousands of eligible small business owners, 1099 self-employed business owners, and gig workers with the Employee Retention Credit and Self-Employed Tax Credit (SETC). We appreciate you joining us on this journey.

Contact the correct department.

TRS (Tax Rebate Specialists) wants to ensure all support issues get handled promptly, so always send questions to the appropriate department. Always include your consultant ID and the file number, if applicable, for the ERC or SETC file you are inquiring about.

Note: Due to limited staff, please allow five to seven business days for our team to respond before you send a follow up email.

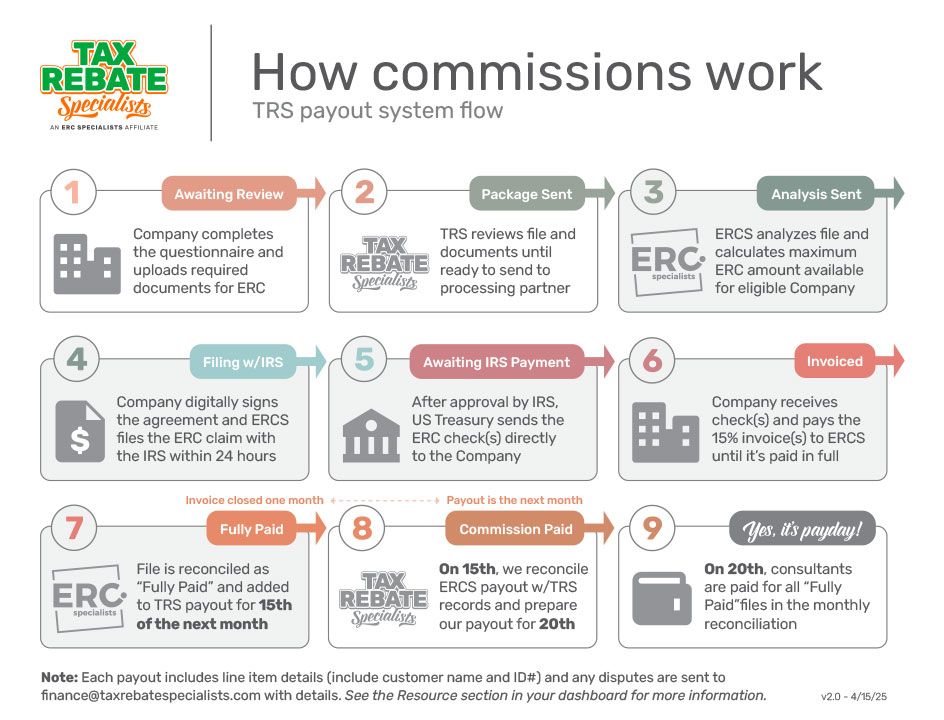

How Commissions Work

For as long as we have consultants with customers that have not been marked "Account Complete" by either ERC Specialists (ERCS) or CLV Law Firm (CLV), TRS will continue watching for file updates and paying out all commissions to our consultants. Thankfully, the process seems to have picked up quite a bit lately, and we hope that all eligible business owners will receive their remaining checks.

Note: Some files may take longer for ERCS or CLV to do a final reconciliation due to disallowance notices, CP-210 issues, collection and legal processes, payment plans, etc. Please use the following information to help us best serve those who still have customers with accounts that have yet to be closed by ERCS or CLV.

TRS Payout Q&A

Q: My customer says they received checks and paid the invoice, so when do I get paid?

A: TRS doesn't pay commissions based on what a customer says to our consultants. We begin our payout process when ERCS marks their fee invoice as paid in full. When you talk to your customers, you must be specific and ask if they paid their entire fee invoice to ERC Specialists. Look in your dashboard and see what the ERCS Status says. If it doesn't say "Fully Paid," ERCS has not marked it as paid in full, and ERCS won't include it in our monthly reconciliation. If their ERCS Status says "Awaiting IRS Payment," they still await one or more outstanding checks. No commissions are paid until the ERCS fee invoice is paid in full.

Q: My customer disputed their disallowance notice, so when will it get updated/resolved?

A: The simple answer is whenever the IRS finishes its process. ERCS will update TRS when the quarter in question is resolved. There is nothing anyone can do to speed up the process. If the customer wishes, they can contact the IRS directly.

Q: My customer has paid all of their quarterly invoices except for the disallowance quarter, so when do I get paid?

A: The TRS payout process remains the same — when the file is marked "Fully Paid." At some point, ERCS will perform a final reconciliation for all outstanding customer invoices, and when they do, TRS will begin the payout process based on the results.

Q: Will I be updated each time my customer receives a quarterly check?

A: No. Due to our limited staff, TRS doesn't update files based on quarterly checks received. However, the customer can log into their ERCS Customer Portal anytime to see where things are for each quarter.

Q: I see a customer is "Fully Paid" so when do I get paid?

A: Once the ERCS Status is changed to "Fully Paid," the TRS payout process begins. The date and method of the last payment will determine whether or not the customer is in the current month's reconciliation. If not, it will be in the following month's reconciliation. If you see a customer file marked "Fully Paid" and have not been paid, please email finance@TaxRebateSpecialists.com with the customer ID# and name to inquire.

Q: Can I speed up the process so my customer will get their remaining checks?

A: No. TRS, ERCS, or CLV cannot speed up the process. It is what it is. However, customers can contact the IRS to inquire about their outstanding checks.

Q: My customer paid part of their ERCS fee invoice. Will I get paid a partial commission?

A: No. TRS doesn't pay out partial commissions. Due to many unknowns like disallowance notices, adjusted fee percentages, quarters deemed ineligible, customers not paying fee invoices, customers withdrawing their credit, customer litigation, customer payment plans, etc., TRS will not pay out commissions on any file except those marked "Fully Paid" by ERC Specialists.

Q: The ERCS Status says "Account Complete," so why haven't I been paid yet?

A: Once a file has gone through ERCS' final reconciliation process, it is marked "Account Complete." If it is successful ("Closed-Won!"), you will be paid your commission. If it is unsuccessful ("Closed-Lost"), there is no commission to pay. Please send any inquiries to finance@TaxRebateSpecialists.com and include the Customer ID# and Name.

Q: Why was another consultant paid their commission on a file, but I haven't received my payout yet?

A: Normally, all consultants are paid on one file simultaneously. However, some circumstances will cause those payments to be split into multiple months. This can include holding a payout toward an ERC Advance Draw or Commission Adjustment. If you have a question about YOUR payout, please email finance@TaxRebateSpecialists.com with your Consultant ID# and Name and the payout in question.

Q: I received an email about my coming commission but haven't seen the deposit yet. What should I do?

A: Your deposit probably didn't go through or wasn't sent due to one or more of the three items listed below. Please check all three items before emailing the TRS finance department. Note: If all three items are done, please email finance@TaxRebateSpecialists.com with your name and consultant ID# to inquire about your deposit.

1: Consultant Profile & Banking Info — TRS cannot pay consultants if we don't have the correct banking information. If you have not updated your banking details, please visit your dashboard ( TaxRebateSpecialists.biz ) and make the appropriate updates to your profile. If we do not have your bank details on file by the end of the day on the 25th of each month, your payout will be delayed until the next payout.

2: Signed W9 — TRS cannot pay consultants if we don't have a completed and signed W9. Please use this link ( https://www.irs.gov/pub/irs-pdf/fw9.pdf ) to download the W9 form and email the signed form back to TRS ( finance@TaxRebateSpecialists.com ).

3: All Info Must Match — Your Consultant Profile, W9, and Banking Info must all match! If you want TRS to pay you as a business, the W9 and Bank Info should match the business name (and EIN) in your Consultant Profile. If you want TRS to pay you individually, the W9 and Bank Info should match the personal name (and SSN) in your Consultant Profile. Any consultant who wishes to change their Consultant Profile from personal to business or from a current business to a new business must complete the CPCR (Consultant Profile Change Request) form and pay $500 to TRS via check or Zelle.

Q: Why is my commission different than the amount listed in my dashboard?

A: The differences are usually due to adjustments to the customer's fee amount paid to ERCS. The fee amount is based on the actual credit the customer received. The fee can be adjusted because the credit amount changed due to ineligible quarters, withdrawn quarters, or an adjusted fee percentage. If the credit is larger than filed initially, your commission will be larger than anticipated. Your commission would be smaller if the credit is less than originally filed. If what you see in your dashboard doesn't match the line item shown in your deposit email, please email finance@TaxRebateSpecialists.com.

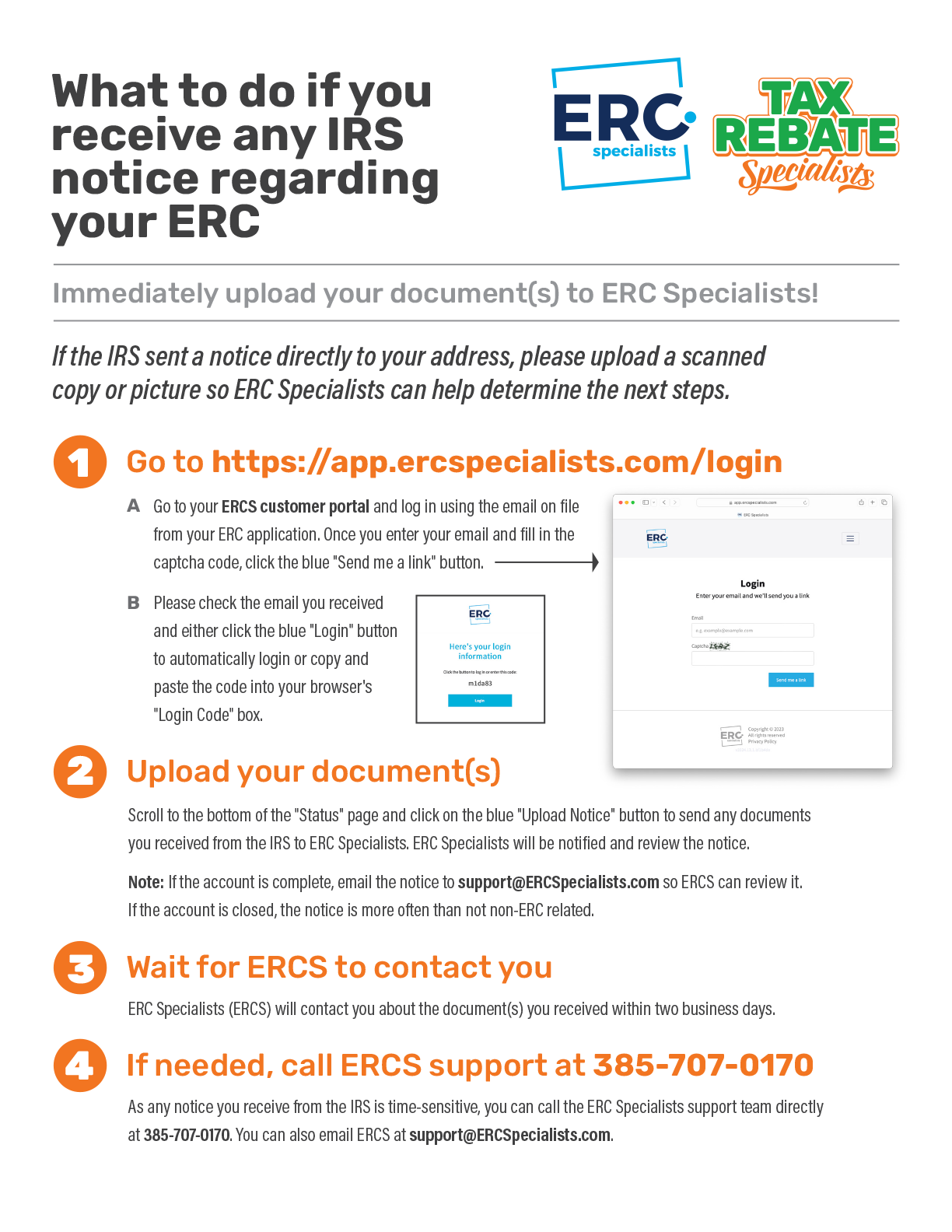

What to do if an ERC customer receives a notice from the IRS

If the IRS sent a notice directly to your customer's address, give them this flyer detailing how they can upload the document(s) to ERC Specialists.

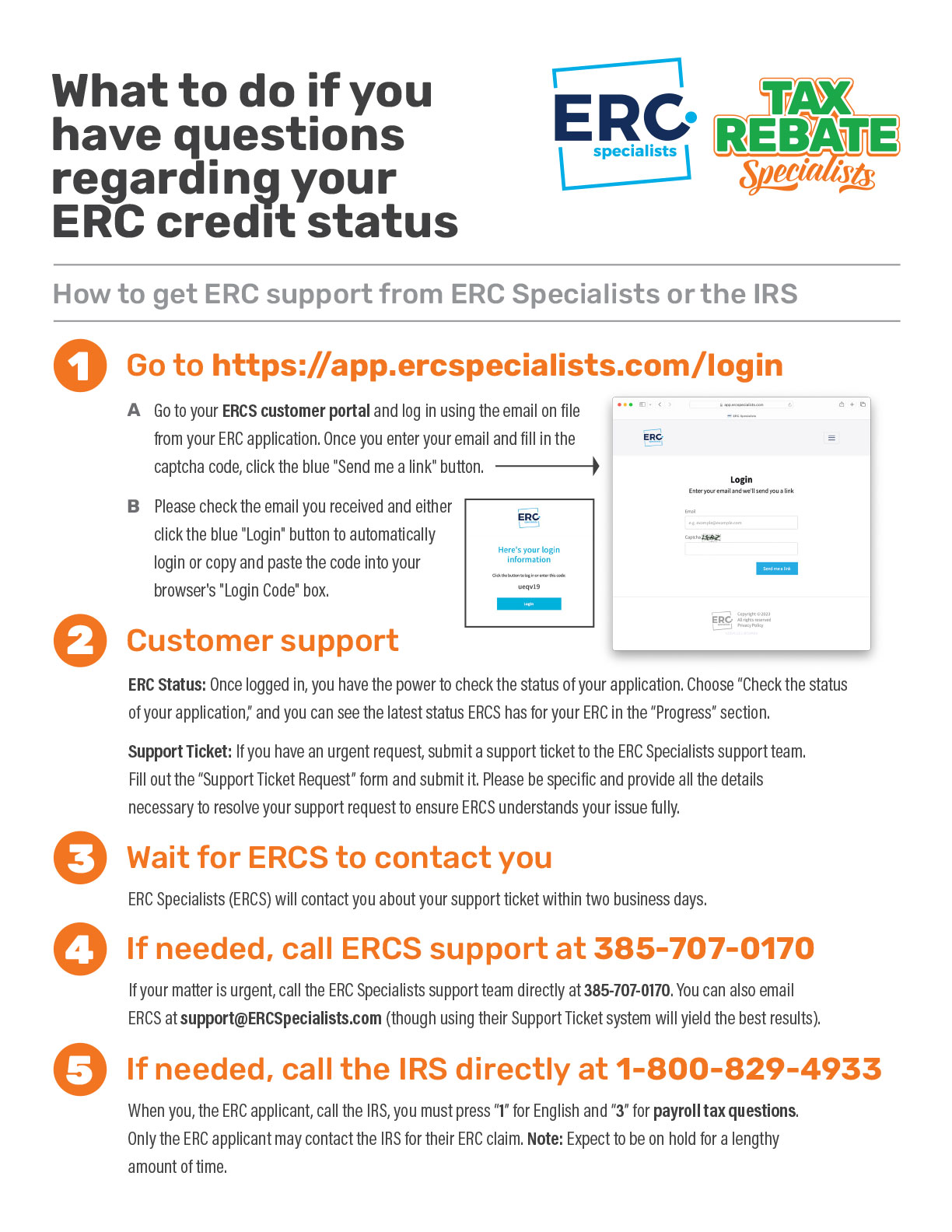

How ERC customers can contact ERCS or the IRS directly

If your customer wants to contact ERC Specialists or the IRS directly, they can follow the instructions on this flyer. Note: They also should have received the email below from ERCS.

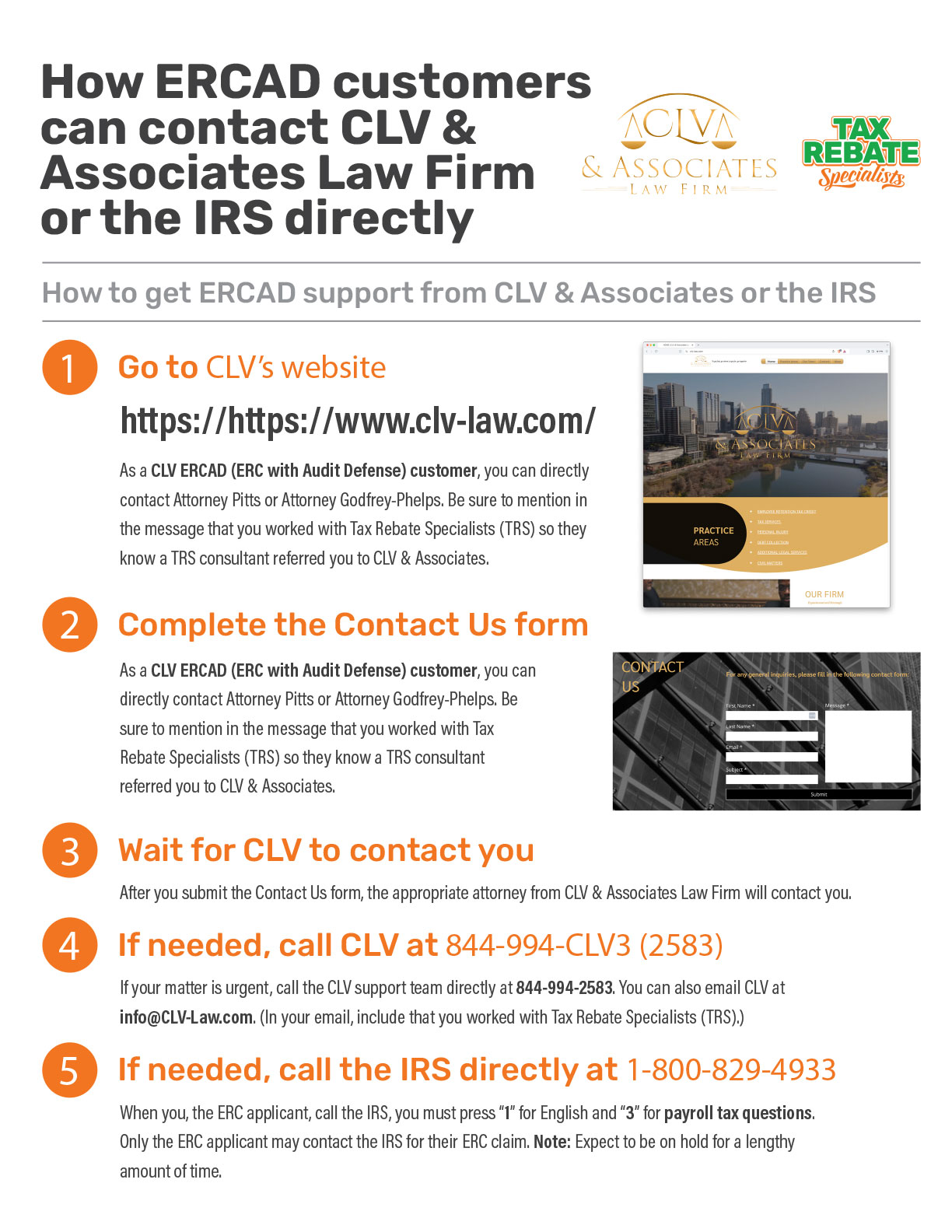

How ERCAD customers can contact CLV or the IRS directly

If your customer wants to contact CLV & Associates Law Firm or the IRS directly, they can follow the instructions on this flyer.

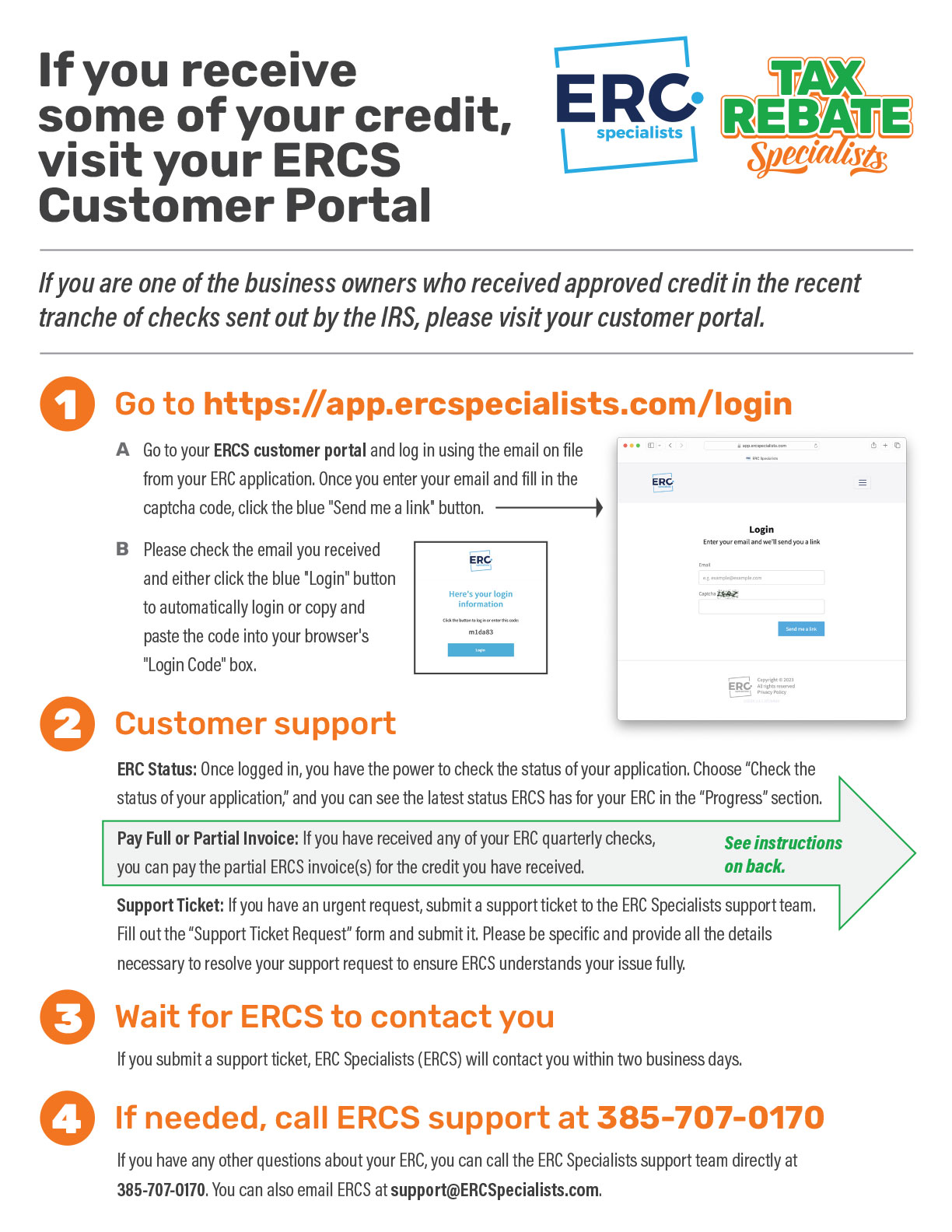

How ERC customers can pay individual invoices as they receive credit

If your customer wants to contact ERC Specialists or pay individual invoices, they can follow the instructions on this flyer.

A tranche of credit was recently sent to ERC customers.

These checks were sent to around 200 customers. Most of them cover only a couple of quarters. If any of your customers' credit is included in this group of checks, we will let you know the specifics so you can follow up. After our TRS webinar on Wednesday, October 23, we will notify the affected TRS consultants by email or phone with the appropriate details.

It's important that you contact your affected customer(s) and share the new two-sided flyer with them. This flyer is a valuable resource that will guide them on how to access their ERCS Customer Portal and pay the invoice(s) for the quarter credit they received.

While we are thankful for these checks being sent, we must remember that we have yet to learn about additional quarters. It's been a long year waiting on the IRS for everyone involved. However, we remain hopeful that all eligible businesses will still receive their credit (sooner rather than later). TRS will update our consultants if another credit tranche is released next month.

Note: If you are still waiting to hear from us after the coming week, your customers were excluded from this credit tranche.

Letter from the ERCS CEO

Note: As a TRS Consultant, you cannot contact ERCS for any reason. TRS is the ERCS affiliate, and all communication must be done through us. Only ERCS customers may contact ERCS directly regarding their Employee Retention Credit (ERC). All TRS independent consultants with customers who received this email will be notified.

Dear (Customer),

You’re receiving this email because ERC Specialists believes you are very likely in a prime position to expedite the recovery of your Employee Retention Credit (ERC) refund. We understand that waiting for this refund has been frustrating, especially with the recent updates from the IRS suggesting there will be further delays in processing your refund. The unfortunate reality is that unless action is taken, you could be waiting even longer for your refund or worse, risk having your ERC disallowed altogether.

If you’re at the point where waiting is no longer an option, or if you’re concerned about the possibility of your refund being disallowed, we want to make sure you understand your rights and your options. We have been working closely with legal counsel that has significant experience and success representing businesses with issues regarding their ERC claims. After reviewing, they have determined that filing a refund suit against the IRS may be your most effective route to obtain your refund. This legal action is very likely the best way to expedite the refund process, ensuring you receive the funds you are rightfully owed.

At ERC Specialists, we’ve been tirelessly working to advocate for the timely processing of our customers’ claims. Despite our efforts, the IRS continues to delay processing thousands of claims, while at the same time disallowing many others. As a reminder, there are generally two methods for establishing ERC eligibility: (1) showing a decline in gross receipts, or (2) demonstrating a full or partial suspension of operations due to governmental mandates. You indicated that you had a decline in gross receipts which means filing a refund suit very likely presents the strongest case to secure your funds quickly.

We understand that the idea of legal action may seem daunting, but we’re here to support you every step of the way and make it an easy option for you. Below, we’ve provided answers to common questions to help clarify the process and alleviate any concerns you may have.

Why is taking legal action necessary?

Filing a lawsuit can compel the IRS to act faster. Litigation creates legal pressure, often leading the agency to prioritize your claim to avoid further legal entanglements or potential negative rulings.

How much will this cost?

One of the most common reasons small businesses hesitate to sue the IRS is the perceived high cost of legal representation. Many business owners worry that hiring a high-profile attorney or law firm to take on a government agency like the IRS will require significant financial resources, which may already be stretched thin.

We understand these concerns, which is why we’ve worked hard to negotiate a solution that ensures you can access top-tier legal help without any immediate financial impact. Through our strategic partnerships with experienced tax attorneys and law firms, we’ve created a plan where you will not need to pay anything upfront. This structure allows you to file a refund suit with no out-of-pocket expenses, ensuring that you’re not taking on additional financial strain just to recover the funds to which you’re entitled.

Will filing a suit cause the IRS to target me?

The IRS is required by law to act fairly and without bias. There are strict legal protections in place to prevent taxpayers from experiencing any form of retaliation, including harassment or unfair audits. Retaliation is prohibited by section 1203 of the Internal Revenue Service Restructuring and Reform Act of 1998. Link. The Commissioner is required to fire any IRS employee who engages in retaliation. The actions and consequences are laid out here. If anyone is interested in additional details from the IRS employee manual, the applicable section is here. We feel the risk for you is if you don’t act.

What are the next steps?

If you’re interested in exploring the refund suit process further, click the link below and verify your contact information.. After you’ve confirmed your information, we will arrange a no obligation nor cost consultation with an experienced tax attorney to answer any questions you might have and outline the path forward. To get started click here [personalized link for customer].

Sincerely,

Mark Sullivan

CEO, ERC Specialists

ERC supporting customers

Note: As a TRS Consultant, you cannot contact ERCS for any reason. TRS is the ERCS affiliate, and all communication must be done through us. Only ERCS customers may contact ERCS directly regarding their Employee Retention Credit (ERC).

Dear Affiliate,

As you may already know, we have seen an influx of disallowance notices from the IRS. The breakdown so far has been as follows:

- Not Operating As a Business

If our advanced software can determine that a customer is indeed an operating business (which is the overwhelming majority), we are encouraging them to appeal. - No Government Order/Partial Suspension

The case can be made that even though there weren't many Q3 2021 government shutdown orders in place, there was a lagging effect from previous shutdown orders that impacted the business in Q3 2021. We are encouraging these customers to appeal. - Failed Gross Receipts Text

The IRS doesn't have enough information to determine this accurately. We are encouraging these customers to review their financial documentation and appeal.

We have also received disallowances due to the business not filing their W2s, no FICA taxes paid, or due to being a government entity. Some of these scenarios will result in the customer not being eligible, but we are working through the ones we can correct. We have also seen many that were disallowed incorrectly due to an IRS error, and we are responding to those directly on behalf of the customer.

What are we doing to support customers?

We are sending out email campaigns for the big three disallowance reasons above. Each customer will have a folder including a letter from us that goes into detail about their disallowance, a protest template that has been drafted by our outside legal counsel, as well as instructions on how to complete the template. We are also providing an instructional video of Ryan from Strong & Hanni to discuss the template (and hopefully build confidence in the appeal process). We have also engaged the law firm to handle the higher dollar "pay now" customers. We want to point out that we do not have the documentation necessary to result in a successful appeal for the top three reasons listed above, which is why we must engage the customer in the process.

How can you help?

Our customer and affiliate support staff is limited, and we are trying to keep them available to assist our customers. Time is of the essence for these business owners, so we are prioritizing customer contacts, which will result in a backlog of Affiliate tickets. The two biggest things you can do to assist are:

- Discuss these unprecedented IRS actions with impacted customers and encourage them to appeal. However, under no circumstances should you complete an appeal on behalf of a customer.

- Refrain from opening tickets. If there is an urgent need for a customer, they need to contact us directly by phone 385-707-0170 or at support@ercspecialists.com.

We appreciate your patience as we diligently work through these efforts. We are hopeful that our efforts will reduce the impact of these notices and that these business owners will receive the credits they are eligible for. As always, we are grateful for you and your support!

Regards,

Affiliate Success Team

ERC Specialists

ERCS shares your frustration

Dear (Customer),

I understand and share your frustration. We have continually updated our processes to remain in line with the guidance the IRS has slowly released over the past couple of years. We submit based on the information received in the questionnaire by the business, and I assure you that our determination is in line with what is outlined in the law.

Unfortunately, the IRS is taking unprecedented action and making determinations that we feel are inaccurate. We are encouraging customers to appeal because we believe you are eligible for this credit and we would hate for you to walk away from what we feel you should receive.

There were many bad actors that entered the ERC processing space, and their lack of compliance has hurt everybody--unethical actions are what resulted in the moratorium. Many of these have already gone insolvent, and their customers are left with no recourse. We have always done everything with a Compliance First mindset, and we stand behind the work we do.

If we could appeal on your behalf, I assure you that we would, but we do not have the ability to do that. Part of the reason for this is we do not have the documentation necessary for a successful appeal. We were only provided payroll and 941s to calculate your credit, but this denial based on Gross Receipts which requires financial records that we don't have.

If you choose not to appeal, our policy as stated in our customer agreement is that we will refund our fee for any disallowed quarters, in spite of the work we have done on the filing. We will not keep money that doesn't result in a successful credit.

We are committed to providing excellent service to our customers regardless of the outcome the amendment.

I am sorry for the aggravation this has caused, it is not the outcome that should have happened, but we are all subject to the determinations of the IRS.

We are here to assist however we can. Thanks for reaching out and sharing your experience.

Best,

VP of Experience

ERC Specialists

What ERCS is doing to help customers with the recent disallowal notices from the IRS

As you may already know, we are seeing an influx of disallowal notices from the IRS. We are currently sitting at a little over 2000 of these. We haven't categorized all of the ones that came in recently yet, but the breakdown so far has been as follows:

- 25% - Not Operating As a Business

- If we have access to tax records, and can see they are indeed an operating business (which is the overwhelming majority), we are encouraging these customers to appeal.

- 52% - No Government Order/Partial Suspension (that impacted the business)

- This is similar...there is also the case to be made that even though there weren't many Q3 2021 shut downs, there was a lagging effect on the supply chain that impacted the business. We are encouraging these customers to appeal.

- 18% - Failed Gross Receipts Test

- The IRS doesn't have enough information to accurately determine this. We are encouraging these customers to appeal.

We have also had a handful of rejections due to the business not filing their W2s, no FICA taxes paid, or due to being a government entity. Some of these scenarios will result in the customer not being eligible, but we are working through the ones we can correct.

We also have had about 4 dozen rejected incorrectly due to an IRS error. These say we didn't check a checkbox . . . but it is clearly checked on the 941s, so we can easily respond to these.

What are we doing to support customers?

Besides researching to see if we feel like the customer should appeal, we will be sending out email campaigns today for the big three disallow reasons. Each customer will have a folder that they will have access to with a letter from us that goes into detail about their disallowal, along with a protest template that has been drafted by our outside legal counsel, as well as instructions on how to complete the template. We are also providing a video of Ryan from Strong & Hanni to discuss the template (and to hopefully build confidence in the appeal process).

I also want to call out Pay Now customers...since these customers have already paid, we are handling them with "Kid Gloves" and are having Ryan at Strong & Hanni reach out to these customers directly.

[Note: TRS will add the shared resources here once we have access to them.]

How can you help?

Our customer and affiliate support staff is limited, and we are trying to keep them available to assist our customers. Time is of the essence for these business owners so we will be prioritizing customer contacts which will result in a backlog of Affiliate contacts. If you have an affiliate network, the biggest thing you can do to help is to tell them not to reach out right now. The customers need to be the ones determining how to proceed. . . . We appreciate your patience as we diligently work through this torrent of notices.

We are hopeful that our efforts should reduce the impact of these notices and that we can get these business owners the credits they are eligible for. As always, we are grateful for you and your support!

In response to questions ERCS has been receiving from customers about the IRS News Release, this follow up communication was sent on 6/25/24.

Dear [Customer],

As we've received customer inquiries regarding the IRS News Release from last week, we wanted to provide some additional clarification.

Customers have reached out wanting to know which risk category they fall into. The IRS has not shared their criteria for these categories beyond what is listed in the News Release.

Based on our processes, we feel most of our customers will land in the "low" to "medium" risk categories. Based on our experience in filing this specific credit, we feel the "high" risk category may be comprised on businesses that didn't pay wages or didn't exist during the eligibility period, and filed claims anyway.

We have recently seen promising results from customers reaching out to their local government representatives. If you have not already done so, we'd encourage you to share your concerns and frustrations with the delays in ERC processing.

As always, we're here to support you. Thanks you for your continued trust in us.

Sincerely,

Mark Sullivan

ERC Specialists, CEO

In late June 2024, Mark Sullivan (ERC Specialists, CEO) emailed ERCS customers in Awaiting IRS status.

Dear (Customer),

As you know, we've all been waiting on the IRS for information about the ERC processing moratorium ending. The IRS released an update yesterday, found here: IRS News Release - IR-2024-169.

The main points include:

The IRS has used the time since the moratorium was implemented to digitize information and analyze unprocessed ERC claims.

Based on their analysis, they have separated pending claims into 3 categories:

1. Claims filed before the moratorium, determined to be "low risk," will begin to be processed, at a slower speed than they were previously, with the first payments for these claims being sent out later this summer. This is great news!

2. Claims filed before the moratorium, determined to be "medium risk," may require additional information from the taxpayer before processing.

- For customers in this category, there is nothing that needs to be done now.

- If the IRS reaches out to you for additional information, ERC Specialists can provide a packet of supporting documentation for your ERC claim.

3. Those claims determined to be "high risk" will be denied.

- These claims include filings with warning signals that clearly fall outside the guidelne established by Congress.

- ERC Specialists did not knowingly file any high-risk claims. If the information provided in your questionnaire was accurate, and you reviewed your eligibility criteria prior to submitting your claim, you can rest assured that we stand by the quality of our work and our processes in filing ERC claims. Compliance with IRS guidelines has always been our top priority.

Note: Claims filed during the moratorium (after September 14, 2023) will not be processed at this time. The IRS will be working with Congress to determine next steps for these claims.

We will let you know when we receive any additional updates.

Generally, the oldest claims will be worked first.

The IRS cautioned taxpayers that the process will take time, and warned that processing speeds will not return to levels that occurred last summer. The agency emphasized those with ERC claims should not call IRS toll-free lines because additional information is generally not available on these claims as processing work continues.

The ERC is a legitimate program, and we expect the IRS to fulfill its obligation to eligible businesses and pay out the credits they claimed. Again, if the information you provided in the questionnaire was accurate, and you reviewed the eligibility criteria when you made your claim, you can rest assured that we stand by our quality of work and our processes in filing your ERC claim. Compliance with IRS guidelines surrounding the ERC has always been our top priority.

The IRS has provided tools, including an ERC Eligibility Checklist, Warning Signs of an Incorrect ERC Claim, and an ERC FAQ — all are linked in the news release. These may be helpful if you'd like to review your claim.

Please let us know if you have any concerns, questions, or if you would like a copy of the supporting documentation for your ERC claim.

Thank you for trusting ERC Specialists with your business.

Sincerely,

Mark Sullivan

ERC Specialists, CEO

In May 2024, Mark Sullivan (ERC Specialists, CEO) emailed every ERCS customer dealing with the IRS delay.

Dear [Customer],

Thank you for choosing to process your claim with ERC Specialists. We understand the frustration you may be experiencing regarding the delay in receiving responses from the IRS. We want to assure you that we are committed to supporting you through this process.

We recognize that the IRS processing delays are impacting your financial situation and business operations. Although we do expect the IRS to resume processing at some point, to expedite the process, we encourage you to reach out to your local political representatives.

Your voice matters, and by expressing your concerns to government leaders in your area, you can help bring attention to the issue and prompt action.

To assist you in this outreach initiative, we have prepared a message for you to share with your local government representative.

Simply visit this link [customized for customer] to access the message, along with direct links to your local senator's contact form. Reaching out to your local senator is the most effective way to address and resolve this issue.

This outreach will only take one minute of your time, yet its effects will be far-reaching, benefiting not only your business but also thousands of small businesses throughout the country.

If you have any questions or need further assistance, please do not hesitate to contact us at irsdelay@ercspecialists.com.

We are here to support you every step of the way.

Sincerely,

Mark Sullivan

ERC Specialists, CEO

There are two statuses for each ERC file: TRS Status and ERCS/CLV Status

All ERC file work by TRS, ERCS, and CLV ceased when we reached the IRS deadline at the end of January. At this time, all files were internally tagged as "Closed-Lost" or "Closed-Won!" by TRS. Any ERC not filed with the IRS by that date did not make it through the process. Note: Always look at the ERCS/CLV Status to determine the current state of a customer's ERC.

Tax Rebate Specialists

If an ERC file was rejected, abandoned, or did not make it through to either ERCS or CLV, it has been tagged as "Closed-Lost." Any TRS status other than "Package Sent" or "Paid-Complete" in your TRS dashboard indicates that the file is considered "Closed-Lost."

ERC Specialists

If an ERC (Employee Retention Credit) file was sent to ERCS, completed its process, received a credit amount, approved by the business owner, and filed with the IRS, it has been tagged as "Closed-Won!" However, it's important to note that this tag does not indicate that the file has been processed by the IRS and checks sent to the eligible business owner. Note: In addition, if a file is deemed ineligible by the IRS or a customer voluntarily withdraws their ERC, a "Closed-Won!" file will be changed to "Closed-Lost" in your dashboard.

CLV & Associates Law Firm

If an ERCAD (ERC with Audit Defense) file was sent to CLV, completed its process, received a credit amount, approved by the business owner, and filed with the IRS, it has been tagged as "Closed-Won!" However, it's important to note that this tag does not indicate that the file has been processed by the IRS and checks sent to the eligible business owner. Note: In addition, if a file is deemed ineligible by the IRS or a customer voluntarily withdraws their ERC, a "Closed-Won!" file will be changed to "Closed-Lost" in your dashboard.

Documents & Articles

TRS Statement of Policies and Procedures

Please download and read the latest version of our policies and procedures.

TRS Tiered Compensation Plan

Read about the Tax Rebate Specialists tiered compensation plan for ERCs and SETCs.

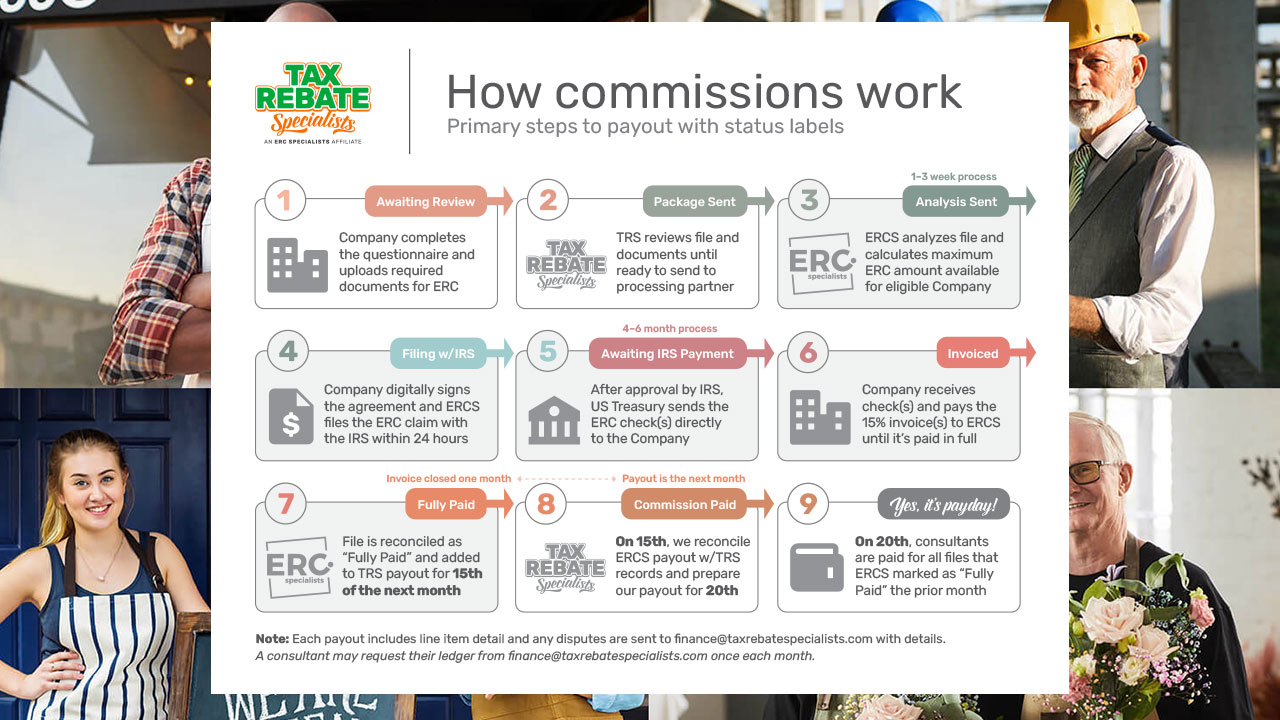

How Commissions Work

Understand the process Tax Rebate Specialists uses to pay out commissions to our independent consultants.

How Does Employee Retention Credit Affect The Tax Return?

IRS Push to Tackle Covid-Era Claim Backlog Threatened by Lawsuit

Employee Retention Credit Claim Resolution Has No End in Sight

What To Do With ERC Refund Claims And IRS Denial Or Recapture Letters

IRS Makes Surprising Concession In Employee Retention Credit Lawsuit

Trump's IRS Pick Billy Long Is Sweet on the Fraud-Plagued Employee Retention Tax Credit

IRS accelerates work on Employee Retention Credit claims; agency currently processing 400,000 claims worth about $10 billion

Did You Receive a Notice of Claim Disallowance for Your Employee Retention Credit Refund Claim? If So, Now What?

IRS Restarts Processing of Some ERC Refunds: What to Know

IRS reopens Voluntary Disclosure Program to help businesses with problematic Employee Retention Credit claims

IRS to start ‘intensifying audits’ on bogus employee retention claims

Senate Kills Bipartisan Tax Bill

Employee Retention Credit Voluntary Disclosure Program to Be Reopened: What You Need to Know

1.4 million COVID-era tax credit claims still unprocessed. Congress must urge IRS to act

What To Do If The IRS Denies Your ERC Refund Claim

IRS Breaks ERC Logjam. What Does This Mean For the Average Joe?

IRS Enters Next Stage of ERC Work; Review Indicates Vast Majority Show Risk of Being Improper

What's Happening With the Employee Retention Credit and the IRS?

A Covid Lifeline for Businesses Has Become Curse for the IRS

In Pending Litigation, IRS Reveals Strategy For Managing ERC Backlog

Didn't Get Your Employee Retention Credit? Sue the IRS!

9 Months Into ERC Claim Processing Moratorium, Still a Waiting Game

Why Some Taxpayers With Unprocessed ERC Claims Should Consider Filing a Refund Lawsuit

ERTC Refund Lawsuits: Is Now the Time to File?

What's Next For ERC Refund Claims Pending With the IRS?

IRS Employee Retention Credit Compliance Effort Tops $1 Billion Threshold Since Fall

The IRS Money Hole Gets Deeper